Every industry is undergoing digital transformation, and the finance industry is no exception. The digital wallet adoption is mushrooming, and almost every individual is embracing the cashless facility.

Gone are the days when there were only 4 billion digital wallet users in 2022; now it is expected to exceed 5.2 billion globally in 2026. Speaking of the market, it is anticipated to grow to an exponential level!

Well, the stats don’t lie!

The global digital payments market is expected to go beyond $10 trillion by 2026. (Source: Statista).

Thus, it’s no secret that many businesses (including startups) are going crazy over eWallet app development in 2026!

The growth is so enormous that every 3rd business is working on the plan to build an eWallet app! If you are ready to make an impact, it’s time to run into the guide to eWallet app development in 2026.

What is the eWallet App?

An eWallet app (or digital wallet app) is a mobile application that allows users to store, send, and receive money digitally. Instead of carrying physical cash or cards, users can complete transactions through their smartphones.

These apps integrate with banks, payment gateways, or card providers to process payments seamlessly. They also often support QR codes, NFC technology, and peer-to-peer (P2P) transfers.

Some popular examples of e-Wallets include PayPal, Apple Pay, Google Wallet, and Venmo. However, as the demand grows, niche and business-specific wallet apps are emerging—giving businesses a way to offer personalized payment solutions to their customers.

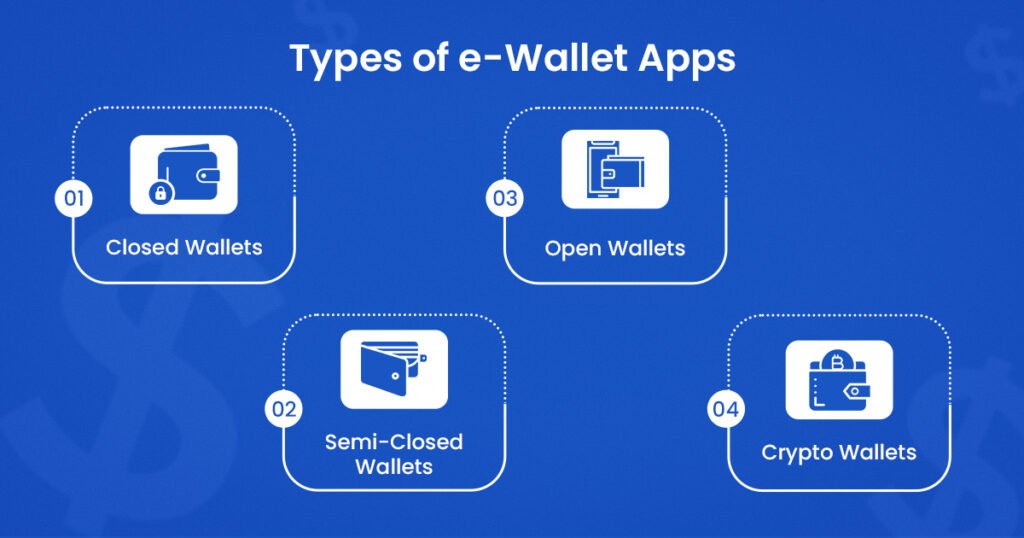

What Are the Types of e-Wallet Apps? (And Which One Costs More to Build?)

e-Wallet apps come in several forms, each designed for different use cases, industries, and user needs. Understanding the main categories will not only help you choose the right type for your business but also estimate the development cost, since some wallet types require significantly more complex features, integrations, and compliance measures than others.

Here are the four primary types of e-wallet apps, along with insights into which ones are the most expensive to build.

1. Closed Wallets

Best for: Single-brand ecosystems (eCommerce platforms, retail chains, subscription services)

A closed wallet allows users to store value but only spend it with the issuing company. Amazon Pay Balance is a classic example.

These wallets usually hold refunds, store credits, loyalty points, or prepaid balances.

Features typically required:

- User authentication

- Secure balance storage

- In-app purchases

- Loyalty and rewards management

Development Cost: Lowest

Closed wallets have limited functionality and no requirement for complex third-party integrations, making them the most cost-efficient to build.

2. Semi-Closed Wallets

Best for: Marketplaces, multi-vendor platforms, travel apps, food delivery apps, fintech products

A semi-closed wallet lets users transact with a network of merchants who have an agreement with the wallet provider. Think Paytm Wallet before full KYC integration.

Features typically required:

- KYC/identity verification

- Merchant onboarding module

- UPI, payment gateway integration

- Transaction history and reporting

- Refund and dispute management

Development Cost: Moderate

Because semi-closed wallets must handle payments across multiple vendors, compliance, security, and integration needs push up the cost.

3. Open Wallets

Best for: Banks, neobanks, and regulated fintech institutions

Open wallets can be used anywhere, online, offline, or even at ATMs. Examples include Google Pay and Apple Pay (when linked to partner banks).

Features typically required:

- Full KYC and AML compliance

- Bank-level security (tokenization, encryption, biometrics)

- Card integration (credit, debit, prepaid)

- P2P transfers

- Withdrawals and cash-out features

Development Cost: High

Open wallets require regulatory approvals, bank partnerships, and advanced security frameworks, making them significantly more expensive than closed or semi-closed wallets.

4. Crypto Wallets

Best for: Blockchain startups, Web3 platforms, crypto exchanges, NFT marketplaces

Crypto wallets store public/private keys and allow users to buy, store, send, or swap cryptocurrencies or digital assets.

Types:

- Custodial wallets (centralized control)

- Non-custodial wallets (user holds the keys)

- Hot wallets (online)

- Cold wallets (hardware-grade security)

Features typically required:

- Blockchain integration (BTC, ETH, ERC-20, etc.)

- Seed phrase generation

- Multi-chain compatibility

- Crypto swaps and staking

- High-grade encryption and security audits

Development Cost: Very High

Crypto wallets need blockchain expertise, multi-chain support, high-end security engineering, and often smart contract development, driving the cost to the top of the spectrum.

Benefits of Building an eWallet App

If you’re wondering why so many businesses are investing in eWallet development, here are some key benefits:

1. Convenience for Customers

Customers can make payments anytime, anywhere, without needing cash or cards. This convenience builds trust and loyalty.

2. Increased Customer Engagement

By offering promotions, cashback, and rewards directly through the wallet, businesses can improve engagement and retention.

3. Enhanced Security

Modern wallets use biometric authentication, encryption, and tokenization, reducing the risk of fraud compared to physical cards or cash.

4. Faster Transactions

Transactions are completed within seconds, improving efficiency for both businesses and users.

5. Global Reach

An eWallet allows businesses to tap into global markets by supporting multiple currencies and international transfers.

6. Revenue Opportunities

You can monetize your wallet by charging transaction fees, offering premium services, or partnering with merchants.

7. Eco-Friendly Solution

Digital wallets reduce the need for physical receipts, cash printing, and plastic card production.

What are the Must-Have Features in an eWallet App?

Building a successful digital wallet requires more than just sending and receiving money. Here are the must-have features your eWallet app should include in 2026:

1. User Registration & Profile Management

A simple onboarding process with social logins, email, or phone number verification.

2. Bank Account & Card Integration

Users should be able to link their bank accounts and cards for seamless transactions.

3. Multiple Payment Options

Support for QR codes, NFC, P2P transfers, online payments, and bill payments.

4. Secure Authentication

Biometric login (fingerprint, facial recognition) and two-factor authentication for security.

5. Transaction History

Detailed history of payments, transfers, and receipts for transparency.

6. Real-Time Notifications

Push notifications to alert users of payments, offers, or suspicious activities.

7. Loyalty & Rewards Integration

Cashback, discounts, and loyalty programs to keep users engaged.

8. Multi-Currency & Cross-Border Payments

Essential for businesses targeting international customers.

9. AI-Powered Fraud Detection

Advanced security to detect unusual patterns and prevent fraud.

10. Customer Support Integration

In-app chatbots or support systems for quick help.

11. Bill Splitting & P2P Transfers

Users should be able to split bills with friends or transfer money instantly.

12. Admin Dashboard

For businesses to manage transactions, track analytics, and monitor fraud.

What are the Security & Compliance Requirements?

Security is the backbone of every e-wallet application. Users trust these platforms with sensitive financial details, identity documents, and transaction data, making strong protection measures non-negotiable. Beyond technical safeguards, regulatory compliance ensures that the wallet operates legally and meets global financial standards. Below are the essential security and compliance requirements, explained in depth.

1. Regulatory Compliance: KYC, AML, and CFT

Every e-wallet must comply with government-mandated identity and financial regulations such as Know Your Customer (KYC), Anti–Money Laundering (AML), and Countering the Financing of Terrorism (CFT). These frameworks ensure that only verified users can access the wallet, prevent fraudulent accounts, and monitor high-risk or suspicious financial activities. Compliance typically involves identity verification, sanction-list screening, and automated reporting to regulators, making it a foundational requirement for any wallet handling real money.

2. PCI DSS Adherence for Card Security

If an e-wallet stores or processes card information, it must follow the Payment Card Industry Data Security Standard (PCI DSS). This global standard ensures secure handling of cardholder data through strong encryption, access controls, network monitoring, and frequent vulnerability assessments. Meeting PCI DSS requirements is essential for reducing the risk of card fraud, safeguarding sensitive payment details, and maintaining trust among users and partner financial institutions.

3. End-to-End Data Encryption & Tokenization

All sensitive data, such as personal details, transaction records, and payment credentials, must be protected using strong encryption protocols like AES-256 for data at rest and TLS 1.2+ for data in transit. Many modern e-wallets also rely on tokenization, replacing sensitive data with secure, non-exploitable tokens. This ensures that even if data is intercepted, it remains unusable, significantly reducing the risk of breaches and unauthorized access.

4. Strong Authentication & Access Control

Robust authentication mechanisms are critical to preventing unauthorized access. e-Wallets typically implement multi-factor authentication (MFA), including OTP verification, biometrics (like fingerprint or facial recognition), or device-based authentication. Combined with strict role-based access control on the backend, these measures ensure that both users and internal systems access only what they are authorized to, strengthening the app’s defense against identity theft and account takeover attacks.

5. Continuous Monitoring, Audits & Fraud Prevention

Security is not a one-time implementation; it requires continuous monitoring and regular auditing. Modern e-wallets use real-time fraud detection tools to analyze user behavior, flag suspicious transactions, and prevent unauthorized activities. Complementing these systems, routine penetration testing, code reviews, and infrastructure audits ensure newly emerging vulnerabilities are identified and resolved quickly. This ongoing vigilance keeps the app secure as threats evolve.

How to Build an eWallet App?

Building an eWallet app requires careful planning and execution. Here’s a step-by-step process to guide you:

Step 1: Research & Define Your Niche

Identify your target audience and unique selling proposition. Are you building a wallet for retail payments, cryptocurrency, or enterprise use?

Step 2: Choose the Right Business Model

Decide how your wallet will generate revenue—transaction fees, premium features, or merchant partnerships.

Step 3: Select Features & Technology Stack

Define must-have features (as listed above) and select technologies like:

| Category | Technologies / Tools |

| Front-End (Mobile App) | Flutter, React Native, Swift (iOS), Kotlin (Android) |

| Back-End Development | Node.js, Python (Django/Flask), Java (Spring Boot), .NET Core |

| Database | PostgreSQL, MySQL, MongoDB, Firebase |

| Cloud & Hosting | AWS, Google Cloud Platform (GCP), Microsoft Azure |

| Payment Gateway Integration | Stripe, PayPal, Razorpay, Braintree, Paytm |

| Security & Encryption | AES-256, SSL/TLS, Tokenization, OAuth 2.0, JWT |

| KYC & Verification Tools | Onfido, Jumio, Trulioo, IDology |

| Blockchain (For Crypto Wallets) | Ethereum, Polygon, Solana, Web3.js, WalletConnect |

| Push Notifications | Firebase Cloud Messaging (FCM), OneSignal |

| Analytics & Monitoring | Firebase Analytics, Mixpanel, Amplitude, AppDynamics |

| Third-Party APIs | Plaid, CurrencyLayer, Twilio, Google Maps |

Step 4: Design UI/UX

A clean, intuitive interface is crucial. Your app should be easy to navigate while ensuring high-level security.

Step 5: Develop the App

Build the frontend and backend, integrate payment gateways, and ensure proper data encryption.

Step 6: Test Rigorously

Run security tests, performance tests, and usability tests. eWallets handle sensitive financial data, so thorough testing is non-negotiable.

Step 7: Launch & Marketing

Release your app on iOS and Android, and create a marketing strategy to acquire users.

Step 8: Maintenance & Updates

Continuously improve with new features, bug fixes, and compliance with financial regulations.

How Much Does It Cost to Build an eWallet App in 2026?

The cost of developing an eWallet app depends on several factors:

1. Features & Complexity

A simple wallet with basic features (like money transfer and bill payments) may cost up to $50,000. A feature-rich, enterprise-level wallet with AI fraud detection, multi-currency support, and advanced security can cost $100,000 – $250,000+.

2. Design

A sleek and modern design with animations and custom elements adds to the cost.

3. Technology Stack

The choice of technologies, APIs, and payment gateway integrations influences cost.

4. Team Location

Hiring developers in North America or Europe costs significantly more than outsourcing to Asia.

5. Compliance & Security

Since wallets deal with money, investing in PCI DSS compliance, encryption, and fraud prevention tools is crucial.

6. Ongoing Maintenance

Budget at least 15–20% of development cost annually for maintenance, updates, and server costs.

In short, building an eWallet app in 2026 is a serious investment—but with the right strategy, it can generate massive returns through transaction fees, partnerships, and customer engagement.

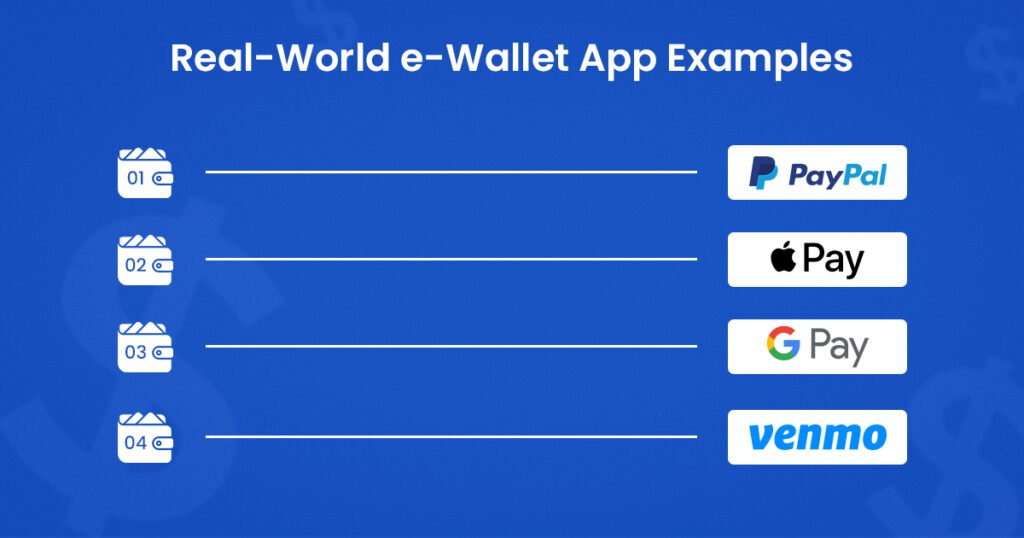

What are the Real-World e-Wallet App Examples?

The e-wallet market has seen tremendous growth, with various apps offering innovative solutions for digital payments, money transfers, and financial services. Here are four notable real-world examples that showcase different types of e-wallets and their unique features:

1. PayPal

PayPal is one of the most globally recognized open wallet platforms. It allows users to make secure online payments, send and receive money across borders, and shop with multiple currencies. Its integration with thousands of merchants and support for mobile, web, and in-app transactions make it a versatile and reliable choice for both individuals and businesses. PayPal’s emphasis on security, including encryption and fraud protection, has contributed to its global popularity.

2. Apple Pay

Apple Pay is Apple’s native mobile payment solution, enabling seamless contactless payments on iPhone, iPad, Apple Watch, and Mac. It supports in-store purchases, online shopping, and in-app transactions with tokenized card security. Its integration into Apple devices and services ensures a frictionless user experience, while biometric authentication through Face ID or Touch ID adds an extra layer of security. Apple Pay has become a go-to choice for iOS users seeking convenience and safety.

3. Google Pay

Google Pay is an open wallet platform that combines UPI payments, bank transfers, bill payments, and reward programs. It allows users to link their bank accounts or cards and pay quickly both online and offline. With its clean interface, instant transaction notifications, and cashback offers, Google Pay has become one of the most user-friendly e-wallets globally. Its integration with other Google services also enhances the overall user experience.

4. Venmo

Venmo is a semi-closed wallet popular in the United States, particularly for peer-to-peer transactions. It combines social features with payment functionality, allowing users to share and comment on transactions with friends. Venmo supports linked bank accounts and debit/credit cards, making transfers simple and fast. Its social aspect and ease of use have made it especially popular among younger users looking for convenient, everyday payments.

Conclusion

As we step into 2026, the demand for digital wallet apps continues to rise. Businesses that invest in building their own eWallet solutions gain a powerful edge as they offer customers convenience, security, and speed while unlocking new revenue opportunities.

From defining your niche and features to choosing the right tech stack and calculating costs, developing an eWallet app requires careful planning and execution. But the rewards are worth it.

If you’re ready to build your own eWallet app, partnering with the right development team is crucial. That’s where EitBiz comes in. With years of expertise in fintech and mobile app development, we can help you design, develop, and launch a secure, user-friendly, and scalable eWallet app tailored to your business needs.

Ready to build an eWallet app? If so, you can call us at +1(317)463-7064 and get in touch with us today